The used car market has always been a fascinating ecosystem where depreciation curves tell hidden stories about consumer trust, technological evolution, and market dynamics. In recent years, one trend has become impossible to ignore: the alarming depreciation rates of electric vehicles (EVs) and plug-in hybrids compared to their internal combustion engine (ICE) counterparts. While environmental advocates celebrate the rise of green transportation, residual value analysts whisper about a growing "value black hole" swallowing early adopters' investments.

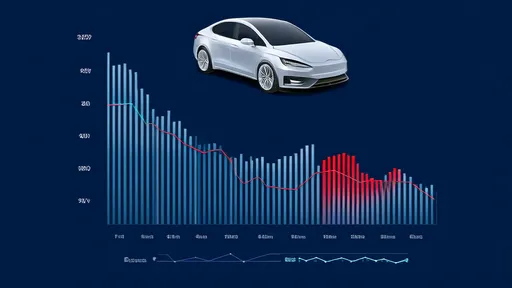

The numbers don't lie. A 2023 industry report tracking three-year retention values revealed that mainstream electric models retained just 35-45% of their original MSRP, while comparable gas-powered vehicles held 50-60%. Luxury EVs fared even worse, with some high-profile models shedding nearly 70% of their value over the same period. This depreciation chasm has created ripple effects across auto finance markets, lease structures, and consumer purchasing behavior.

Battery anxiety forms the core of this valuation crisis. Unlike traditional engines where mileage tells most of the story, EV batteries degrade through complex chemical processes that don't always correlate with odometer readings. Potential buyers face unnerving questions: How many charge cycles remain before performance drops? What will replacement costs be in five years? These uncertainties cast long shadows over resale negotiations.

The pace of technological advancement works against used EV values. Buyers perceive last year's 250-mile range model as obsolete when new versions promise 400+ miles. Similarly, rapid improvements in charging speed and battery management systems make older EVs appear technologically stagnant. This creates a paradox where the very innovation driving EV adoption simultaneously erodes the secondary market.

Dealer apprehension compounds the problem. Many traditional used car operations lack the expertise and equipment to properly evaluate EV battery health. Faced with this knowledge gap, they either avoid EV trade-ins altogether or offer deflated prices to hedge their risks. Certified pre-owned programs for electric vehicles remain rare and underdeveloped compared to established ICE programs.

Market fragmentation adds another layer of complexity. While Tesla dominates mindshare, the explosion of new EV startups means many low-volume models enter the used market without established repair networks or parts availability. For buyers, the prospect of owning an orphaned vehicle from a defunct automaker presents a real financial risk that gets priced into resale values.

Policy winds blow in conflicting directions. Government incentives for new EV purchases—while boosting initial adoption—can inadvertently depress used values by making new models artificially affordable. Meanwhile, the absence of standardized battery health reporting requirements creates information asymmetry that favors buyers over sellers in valuation negotiations.

The commercial vehicle segment reveals an interesting counter-narrative. Certain electric delivery vans and fleet vehicles maintain stronger residuals due to predictable usage patterns and meticulous maintenance records. This suggests that depreciation issues for consumer EVs may stem as much from usage uncertainty as from inherent product flaws.

Lease markets tell a revealing story. Residual value projections for EV leases have become notoriously volatile, with lenders frequently adjusting terms to account for unexpected depreciation. Some lessors now build in larger buffers or mandate higher down payments, effectively passing the risk back to consumers. This financial caution speaks volumes about institutional confidence in long-term EV values.

Regional differences paint a nuanced picture. Markets with robust charging infrastructure and strong environmental policies (like Norway or California) show somewhat healthier used EV values. However, even in these progressive regions, the depreciation gap versus ICE vehicles persists, suggesting deeper structural factors at play.

The psychological dimension shouldn't be underestimated. Car buyers have spent a century understanding gasoline engine depreciation curves. The unfamiliar patterns of battery degradation and technology obsolescence create discomfort that translates into lower offers. Until standardized benchmarks emerge, this "fear of the unknown" will continue suppressing values.

Some industry voices argue we're witnessing temporary growing pains. They point to early mobile phones and flat-screen TVs that similarly suffered extreme depreciation before the technologies matured and stabilized. However, the automotive industry's much longer product cycles mean this stabilization period could span a decade or more.

Emerging solutions offer glimmers of hope. Blockchain-based battery health certificates, manufacturer-backed buyback guarantees, and third-party battery refurbishment programs are all entering the market. Whether these innovations can fundamentally alter the depreciation trajectory remains to be seen, but they represent necessary experiments in solving the valuation crisis.

The insurance industry's evolving stance on EVs adds another wrinkle. Some carriers now offer policies that guarantee battery replacement costs, effectively creating a safety net for residual values. As these products become more widespread, they could significantly impact consumer confidence in used EV purchases.

Looking ahead, the used EV market stands at a crossroads. Current depreciation rates may represent a necessary market correction after years of inflated new EV prices, or they could signal deeper flaws in how we value sustainable transportation. One thing remains clear: until the industry cracks the code on predictable long-term valuation, the "green premium" for electric vehicles will continue being offset by a "resale penalty" that makes many potential buyers think twice.

The coming years will test whether automakers can engineer their way out of this value black hole, or if electric vehicles will permanently reset expectations about what car ownership really costs over time. For now, the used car lots tell a cautionary tale about the hidden costs of technological revolution.

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025