The shared car industry, once hailed as a revolutionary solution to urban congestion and environmental concerns, is facing a harsh reality check. What began as a promising alternative to traditional car ownership has morphed into a business model plagued by high depreciation rates, vandalism, and unsustainable operational costs. The glittering promise of "mobility-as-a-service" is tarnished by the gritty economics of maintaining fleets in cities where users often treat shared vehicles with far less care than their own.

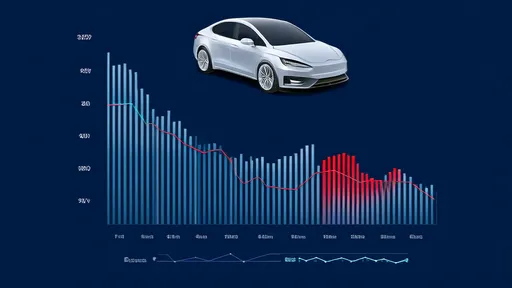

Depreciation hits harder in shared fleets. Unlike privately owned vehicles that might log 10,000-15,000 kilometers annually, shared cars frequently accumulate double or triple that mileage in the same timeframe. This accelerated wear manifests not just in mechanical components but in interior damage - stained seats, broken infotainment systems, and mysterious odors that no amount of detailing can fully erase. The resale value of these vehicles plummets dramatically, creating a financial black hole for operators.

The problem compounds when considering the types of vehicles chosen for sharing programs. Many operators initially selected compact electric vehicles to align with environmental goals and minimize upfront costs. However, these lighter-weight cars often prove less durable under constant use. Suspensions sag prematurely, door hinges loosen from thousands of cycles, and battery degradation accelerates under near-continuous charging cycles. Some operators now report replacing entire fleets every 18-24 months - a timeline that would be unthinkable in traditional rental or private ownership scenarios.

Vandalism and abuse present another layer of financial hemorrhage. Shared vehicles suffer damage rates that would make any fleet manager wince. From simple cleanliness issues to intentional destruction, the spectrum of abuse is staggering. Food spills attract pests, cigarette burns require seat replacements, and malicious actors sometimes disable GPS trackers to enable theft or extended unauthorized use. The anonymity of sharing platforms appears to erode user accountability, with some operators reporting that up to 30% of their fleet is undergoing repairs at any given time.

Operational challenges further strain the model. Unlike traditional rentals where vehicles return to a central location, shared cars scatter across cities, creating a logistical nightmare for maintenance and redistribution. "We spend more on 'rebalancing' our fleet than we do on actual repairs," confessed one operations manager who requested anonymity. The costs of sending staff to retrieve vehicles from remote areas or jump-start dead batteries often eclipse the revenue generated from those rentals.

Insurance costs tell their own damning story. Premiums for shared fleets run 200-300% higher than conventional commercial auto policies. This reflects both the frequency of claims and the severity of incidents - shared cars are more likely to be involved in accidents, partly because users unfamiliar with the vehicle's dimensions and handling characteristics operate them in dense urban environments. Some insurers have begun withdrawing from the shared mobility market altogether, forcing operators to self-insure or form captive insurance entities.

The financial implications of these challenges are becoming impossible to ignore. Several major shared car companies have quietly shifted from owning their fleets to leasing vehicles, transferring some depreciation risk back to manufacturers. Others have introduced stringent user behavior monitoring, with one European operator now charging cleaning fees based on AI-detected interior messes. Such measures, while necessary, erode the user-friendly image that made shared mobility appealing initially.

Consumer behavior lies at the heart of the sustainability problem. The very concept of sharing appears to trigger different psychological responses than ownership. Without the emotional or financial investment in a vehicle, users demonstrate less caution in operation and less consideration in treatment. This phenomenon isn't unique to cars - shared bicycles face similar challenges - but the complexity and value of automobiles make the consequences far more severe. Some operators experiment with loyalty programs and user ratings to encourage better behavior, but results remain mixed at best.

Urban infrastructure often compounds these issues. Cities that enthusiastically embraced shared car concepts frequently failed to provide dedicated parking or charging infrastructure. The resulting chaos - vehicles blocking sidewalks, occupying precious charging spots for days, or abandoned in illegal zones - generates public backlash and municipal fines. These hidden costs further pressure already thin margins.

The industry now stands at a crossroads. Some players are pivoting toward corporate and institutional clients rather than the general public, finding that managed fleets for businesses suffer lower abuse rates. Others are exploring blockchain-based damage tracking or implementing more robust user verification processes. However, these solutions all add complexity and cost to what was supposed to be a simple, accessible transportation alternative.

What began as a vision of fewer cars on the road may ironically be creating more waste through accelerated vehicle cycling. Environmental assessments that initially praised shared models for reducing ownership are being revised to account for the hidden ecological costs of frequent manufacturing and disposal. The sustainable solution, it seems, may lie somewhere between the extremes of universal private ownership and completely decentralized sharing - perhaps in hybrid models that blend elements of both with stronger accountability measures.

The shared car experiment has revealed uncomfortable truths about human nature and the challenges of scaling trust-based systems. While the concept isn't doomed, its current form appears economically unsustainable without significant technological or behavioral breakthroughs. As investors grow wary and cities reassess their partnerships with mobility providers, the industry must either evolve rapidly or risk becoming a cautionary tale in the annals of urban transportation.

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025

By /Jun 14, 2025